Cloud-Based Professional Tax Prep Software

Prepare, review, and file tax returns electronically—seamlessly, anywhere, anytime.

Still Preparing Taxes Without Professional Software?

Here’s Why That Could Be Holding Your Business Back

Relying on manual processes, basic tools, or outdated systems doesn’t just slow you down, it limits your ability to scale, serve more clients, and stay compliant with evolving regulations. Without the right software, you're spending more time on admin, risking costly errors, and leaving revenue on the table.

Introducing the iTax Institute

Cloud-Based Tax Software Built By Tax Professionals, For Professionals

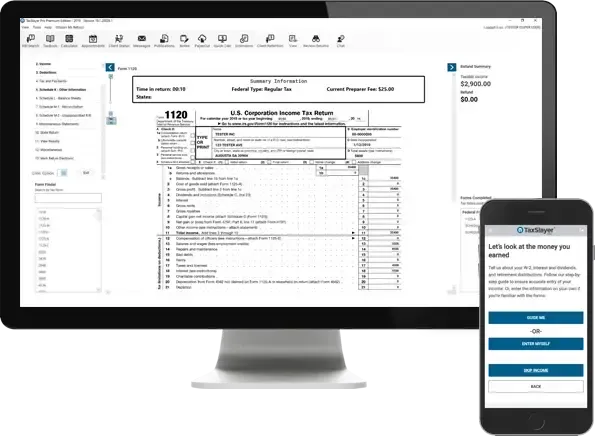

Pro Web + Corporate

Software

Allows you to file individual returns with either cloud-based or desktop-based software. Enjoy the flexibility of the web-based software and the ability to file LLC and corporate returns with the desktop-based software.

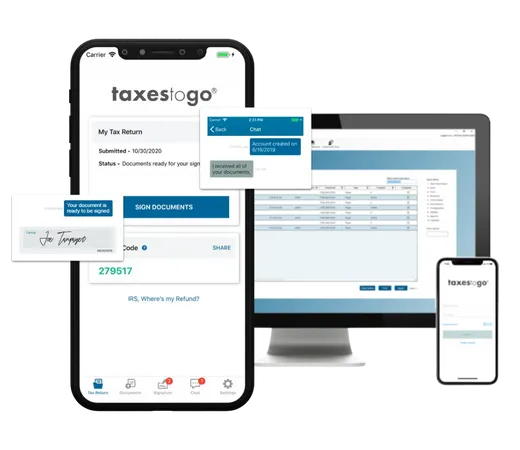

TaxesToGo™

Mobile App

Our mobile app allows you to reach more clients and prepare tax returns in less time.

It allows your clients to safely and securely share tax information with you. You can also chat with your clients in real time from within the app.

Integrated Bank Products

A bank product (also known as a refund transfer) is a convenient payment solution that allows your clients to pay your tax preparation fees directly from their refund, so you don’t have to wait to get paid.

FREE Unlimited

E-Filing

Enjoy no limit to the number of tax returns that can be prepared and filed with your tax software. We don't charge you per return, so you don't feel limited and can continue to grow your business.

Mobile Tax Office

Our tax software allows you to prepare and e-file individual tax returns on multiple devices from anywhere your business takes you with the easy-to-use interface and intuitive menus.

Unlimited Top-Rated Support

Our tax software includes year-round support with every software purchase. Support available in both English and Spanish. No additional fees.

Here are even more perks that make our tax software the ultimate solution for growing your business:

Unlimited 1040 E-filing

Comprehensive Bank

Product Solutions

TaxesToGo® Mobile App

Desktop Corporate Tax Software

Cloud-Based Tax Software

All States Included

Unlimited Top-Rated Support

Refund Estimator Tool

Multiple User Access

Web Bank Integration

Cloud-Based Reporting

Client Retention Database

Paperless Office

Secure Client Portal

Digital Signature Compatible

Available in Spanish

Marketing Materials

Offer advances up to $6,000 to your clients upon bank approval.

What are Bank Products?

A bank product (also known as a refund transfer) is a convenient payment solution that allows your clients to pay your tax preparation fees directly from their refund, so you don’t have to wait to get paid.

Many clients don’t have the funds to cover your fees upfront which can lead to delayed payments, back-and-forth invoices, and unnecessary follow-ups.

By offering bank products through our partner banks, your fees are automatically withheld from the client’s refund and deposited directly to you, often as soon as the refund is funded.

Here's How It Works

Your client receives their refund, and your service fee is automatically deducted, no out-of-pocket cost for them, and no waiting for you.

Plus, these bank products are fully integrated into the software, making the process seamless for both you and your clients.

Backed by Trusted Banking Partners

We’ve partnered with reliable financial institutions to support your tax business with secure, compliant, and efficient payment solutions.

Unlock These Exclusive BONUSES When You Purchase the Tax Software!

Continuing Education Courses - As an authorized CE provider through the IRS, we provide the credits you need to become or maintain your tax preparer AFSP designation

In-Season Tax Return Preparation Assistance

In-Season and Post-Season Software Technical Support

Client intake and due diligence compliance

iTax Institute Instructor will review accuracy of tax return prior to transmission to IRS upon request

Access to Private Telegram Group

Guest Speakers & Additional Streams of Income

Automations and Client E-mail Campaign

End of season business analysis

Everything You Need,

One Affordable Price

With all these powerful features, unlimited filing, expert support, and client-ready tools, you get the complete tax software package for just $597.

Whether you’re just starting out or scaling your tax business, this all-in-one solution gives you everything you need to grow, without the high price tag.