ENROLL NOW TO GET BONUSES & 2 CONTINUING EDUCATION HOURS!

STOP GUESSING

Avoid Penalties up to $63,500

& Get IRS-Ready Due Diligence Systems!

The IRS isn’t playing, one wrong answer or missing note can cost you thousands. The Compliant Preparer Course gives you the proven training, plug-and-play templates, and real-world examples to help you meet — and exceed — IRS due diligence requirements with confidence.

PLUS: Earn 2 hours of IRS-Approved Continuing Education upon completion.

You’re a Tax Professional. You Deserve to Feel Confident, Not Concerned.

The IRS can penalize you up to $63,500 during a single audit. Most tax pros never see it coming... until it’s too late.

What You Get Inside

The Compliant Preparer Course

6 Core Training Modules

Step-by-step video lessons that show you:

What the IRS expects under IRC §6695(g)

How to complete Form 8867 properly

Credit-by-credit breakdowns: EITC, CTC, ACTC, AOTC, HOH, and ODC

Compliant vs. non-compliant documentation examples

How to conduct compliant client interviews

What triggers an audit — and how to avoid red flags

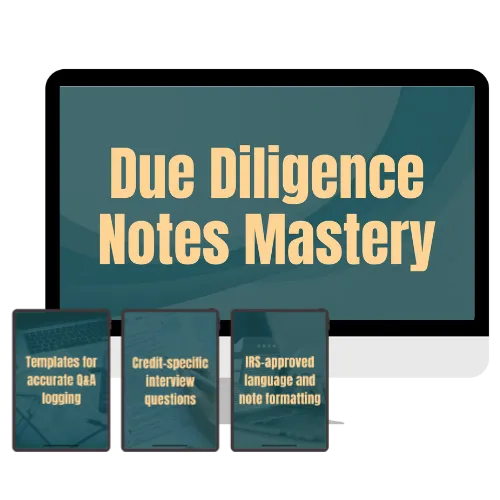

Due Diligence Notes Mastery

Credit-specific interview questions

Templates for accurate Q&A logging

IRS-approved language and note formatting

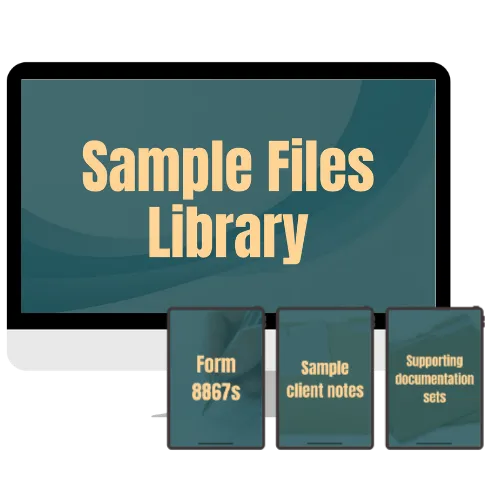

Sample Files Library

Example Form 8867s

Sample client notes

Supporting documentation sets

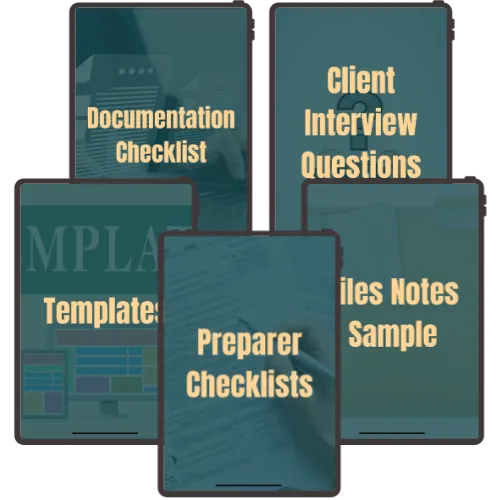

Printable Compliance Tools

Due diligence checklists by credit

Interview log sheets

Eligibility screeners and documentation guides

Certificate of Completion

Official Certificate of Completion for The Compliant Preparer

2 IRS-Approved Continuing Education Hours

Earn 2 IRS-Approved CE Hours upon course completion (for qualifying professionals)

Get These Bonuses When You Enroll

Includes sample response templates, red flag identifiers, and compliance strategies used by top pros.

Real audit scenarios, breakdowns of letters like 4810 and 5025, and strategies for passing with confidence.

Get a printable, ready-to-use checklist that shows exactly what documentation to collect for each credit.

This guide gives you 250+ pre-written questions across all major tax credits.

The Compliant Preparer Training Course

Module Breakdown

MODULE 1: KNOW YOUR ROLE - UNDERSTANDING DUE DILIGENCE

Lesson 1: What is IRS Due Diligence and why it matters

Lesson 2: Key IRS expectations from tax professionals

Lesson 3: Overview of Circular 230 (Ethics & responsibilities)

Lesson 4: The Cost of Getting it Wrong: Audits, Lawsuits, and Lost Licenses

Lesson 5: When Due Diligence turns Criminal

MODULE 2: RECEIPTS AND REALITY

Lesson 1: Breakdown of IRS penalties ($635 per violation, up to $63,500)

Lesson 2: PTIN bans and disciplinary actions (2024 focus)

Lesson 3: Real IRS Audit Letters and Results Revealed

MODULE 3: TRAIN LIKE A PRO - STAY CERTIFIED AND INFORMED

Lesson 1: IRS CE Due Diligence Training (how and why)

Lesson 2: AFSP Certification and its benefits

Lesson 3: How to stay IRS-compliant year-round

Lesson 4: IRS forums and tax conference benefits

Lesson 5: iTax Institute as an IRS CE Provider

MODULE 4: REAL FILES, REAL RISKS, REAL NOTES

Lesson 1: Case studies

Lesson 2: What questions you must ask – sample interview flows

Lesson 3: REAL audit notes from IRS Examiners

MODULE 5: THE FILING STATUS FORMULA

Lesson 1: How AGI and the Federal Poverty Line affect due diligence

MODULE 6: FROM COMPLIANCE TO CONFIDENCE

Lesson 1: iTax Institute’s Due Diligence Services:

Lesson 2: Why professionals choose iTax Institute post-audit

Lesson 3: How to schedule a free consultation

When you join The Compliant Preparer Course,

you’re not just taking a course

you’re investing in peace of mind, professional credibility, and audit protection.

6 self-paced training modules

Plug-and-play compliance templates

2 IRS-approved CE hours

Official Certificate of Course Completion

Notes, interview tools & audit response guides

Includes 4 Bonus eBooks & 2 CE Hours

Backed by Experience, Not Guesswork

This course was created by Ambrea’ Lacy, tax strategist and audit advisor, who has worked with dozens of preparers facing IRS due diligence audits. It’s not theory, it’s based on what the IRS actually asks for during real investigations.

With over a decade of experience, she’s helped hundreds of preparers grow their businesses through expert mentorship and cutting-edge software solutions.

Meet Your Coach

Dr. Ambrea' Lacy

With over a decade of experience, she’s helped hundreds of preparers grow their businesses through expert mentorship and cutting-edge software solutions.

As the founder of a top-tier tax software company, Ambrea’ blends innovation with real-world strategy, giving professionals the tools and confidence to scale with purpose. Whether you’re just starting out or ready to level up, Ambrea’ is here to help you lead, grow, and succeed.

Don’t Wait for the IRS to Come Knocking

The fines are real. The stress is avoidable. Invest in The Compliant Preparer Course today and protect your business the right way.