GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

No Gatekeeping!

Join Dr. Ambrea’ Lacy and Walk away confident, audit-ready, and equipped with actionable steps to protect your clients and your practice

CLICK 🔊 TO ENABLE SOUND

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

VALUABLE HIGHLIGHTS

Live Training

with Ambrea'

Legal Insights from

Atty. Josie Walton

Interactive

workbook

Due Diligence

Cheat Sheet

WISP &

Cybersecurity Guide

Client Interview &

Intake Template

UPCOMING LIVE TRAINING ON STAY TUNED

Seats are extremely limited to maintain an interactive experience.

Once full, this training won’t return for months.

THE IRS CAN FINE YOU UP TO $63,500

Thousands of tax professionals are audited every year for errors on EITC, CTC, ACTC, AOTC credits and Head of Household filing status returns often because of missing due diligence notes and supporting documentation.

If you weren't taught proper due diligence when you were trained how to prepare taxes, your profits, PTIN and peace could be at risk risk without you even knowing it.

WHO THIS TRAINING IS FOR

Professionals filing returns claiming EITC, AOTC, CTC, ACTC, and Head of Household. If you’re responsible for client returns and want to protect your practice from audits, this training is for you.

Tax professionals at all experience levels, from brand-new preparers to seasoned PTIN holders.

EROs who want to ensure compliance and avoid costly errors.

Service bureaus seeking to build strong due diligence systems across their teams.

Tax pros who are serious about due diligence and committed to protecting their clients and their business.

WHO THIS TRAINING IS NOT FOR

Tax pros who believe due diligence is optional or “just paperwork.”

Anyone looking for shortcuts instead of proven, step-by-step systems.

Professionals who aren’t serious about protecting their practice, clients, and reputation.

Those willing to risk $63,500 fines rather than invest in compliance.

People expecting a passive lecture. This training is interactive, hands-on, and built for action takers.

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

Responsibilities of paid tax preparers under IRS rules

Clear breakdowns of EITC, AOTC, CTC, ACTC, and HOH filing status

How to choose HOH vs. Single filing status correctly

IRS red-flag triggers and how to avoid them

Interactive case studies simulating real audit scenarios

Step-by-step checklists, SOPs, and client interview techniques

Best practices for securing client information virtually and in-office

How to build a fully compliant client file every time

Legal strategies to protect your practice from risk

Plus: Earn 2 CE hours for your participation.

ATTENTION: Some tools, and bonuses listed above are exclusive to VIP attendees ONLY.

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

CONSIDER THIS

CLEAR ROI

A single due diligence

mistake can cost your practice

up to $63,500 per error.

You can learn exactly

how to avoid these mistakes and build an audit-proof system.

That’s less than 0.25% of the potential cost of one error.

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

🎟️GENERAL ADMISSION

$97

1 Day of Training

30-Day Recording Access

Certificate of Completion

Homework + Implementation

No CE Hours

No Live Q&A

No Homework Review/Feedback

No Cybersecurity & WISP Template

No Bonus Ebooks, Templates, and Tools

👑VIP EXPERIENCE

$197

⭐ 2 Days of Training

⭐ 30-Day Recording Access

⭐ Certificate of Completion

⭐ Homework + Implementation

⭐ 2 CE Hours

⭐ Live Q&A

⭐ Homework Review/Feedback

⭐ Cybersecurity & WISP Template

⭐ Bonus Ebooks, Templates, and Tools

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

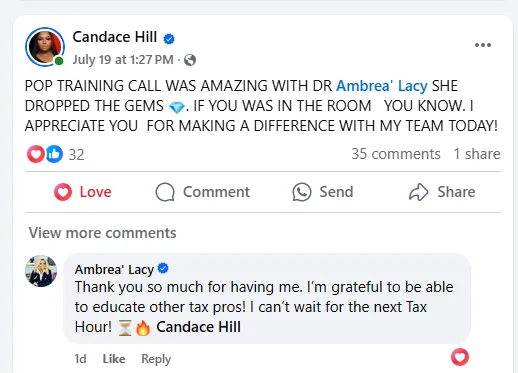

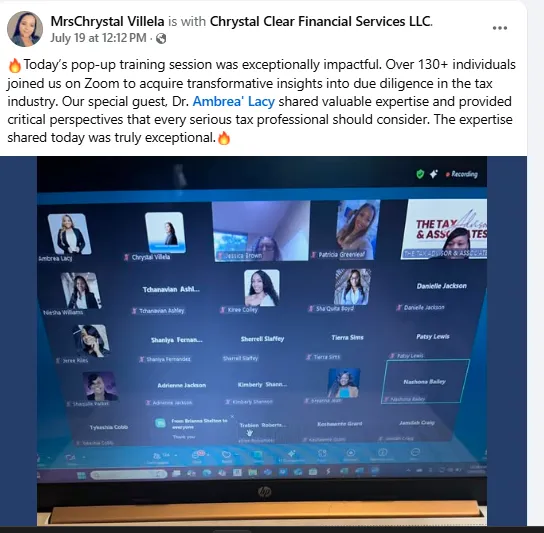

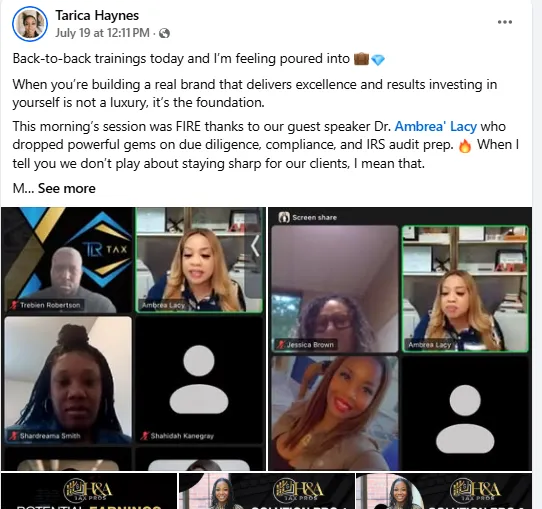

Dr. Ambrea’ Lacy

15+ years in the tax industry

Helped tax pros start, grow, and scale profitable tax businesses

Navigated a real IRS due diligence audit, giving firsthand insight into what the IRS looks for

Shares step-by-step systems, templates, and actionable strategies to safeguard your clients and practice

"This is not just another compliance course. This is your opportunity to safeguard your practice, enhance your due diligence processes, and ensure compliance with IRS regulations—all in one comprehensive session."

Atty. Josie Walton - Tax Attorney

Licensed tax attorney with deep expertise in IRS compliance and liability

Provides legal guidance on protecting your practice, maintaining compliance, and defending against audit issues

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

GET READY, DUE DILIGENCE LIVE TRAINING ON: STAY TUNED

Interactive

Workbook

Exercises, templates, and case studies to follow along live

Due Diligence Cheat Sheet

Quick-reference guide including IRS red-flag triggers

WISP & Cybersecurity Guide

Protect client data virtually and in-office

Client Interview & Intake Template

Ready-to-use form for compliant documentation

ATTENTION: Exclusive materials available to VIP attendees ONLY.

Reserve Your Spot Now!

Seats are extremely limited to maintain an interactive, high-value experience. Don’t risk IRS fines up to $63,500 — learn step-by-step systems, templates, and legal insights that protect your practice, plus earn 2 CE hours.

Lock in your seat today before it sells out.

Once seats are gone, this training is gone.

Follow Ambrea' Lacy

© Copyright Lacy Financial Advisors 2025. All rights reserved.

Facebook

Instagram

Youtube

TikTok