Masterclass Starts In:

ATTENTION: Tax Professionals

FREE Due Diligence Masterclass

Avoid IRS Fines, Lawsuits

& Criminal Charges.

Protect Your Tax Practice

Join us live and learn how to stay compliant,

avoid up to $65,000 in potential fines, and

safeguard your reputation.

Live on Currently Unavailable. We’ll Be Back Soon.

Masterclass Starts In:

ATTENTION: Tax Professionals

FREE Due Diligence Masterclass

Avoid IRS Fines, Lawsuits & Criminal Charges.

Protect Your Tax Practice

Join us live and learn how to stay compliant,

avoid $63,500 in potential fines, and

safeguard your reputation.

Live on Currently Unavailable. We’ll Be Back Soon.

Stop and Watch This First!

Every Tax Pro Needs to Hear This

CLICK 🔊TO LISTEN

Learn exactly what to do if you receive a Due Diligence Audit Letter or how to prepare before you get one.

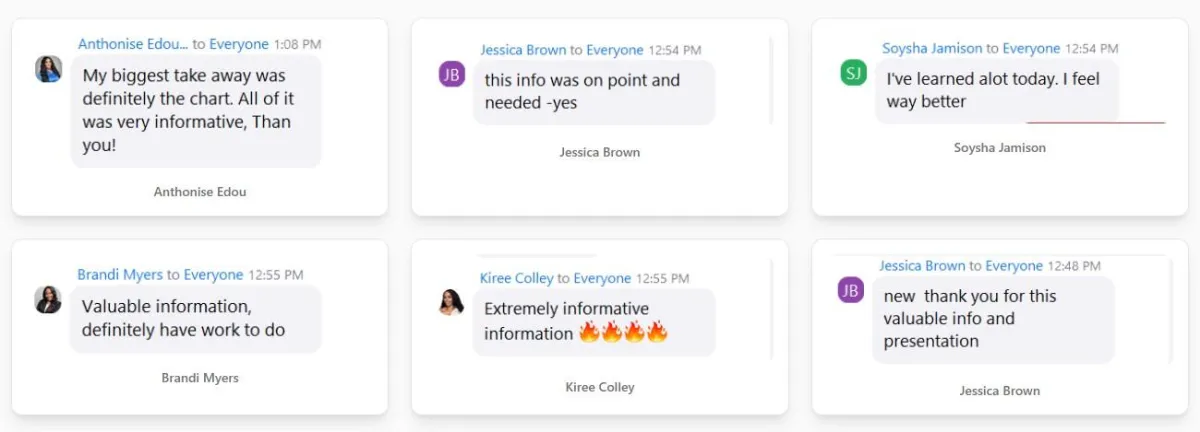

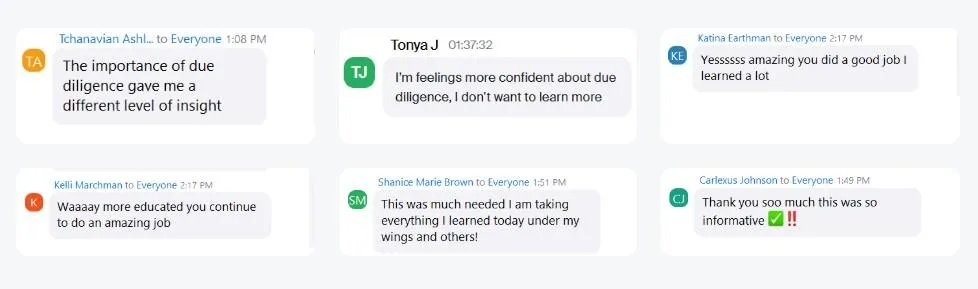

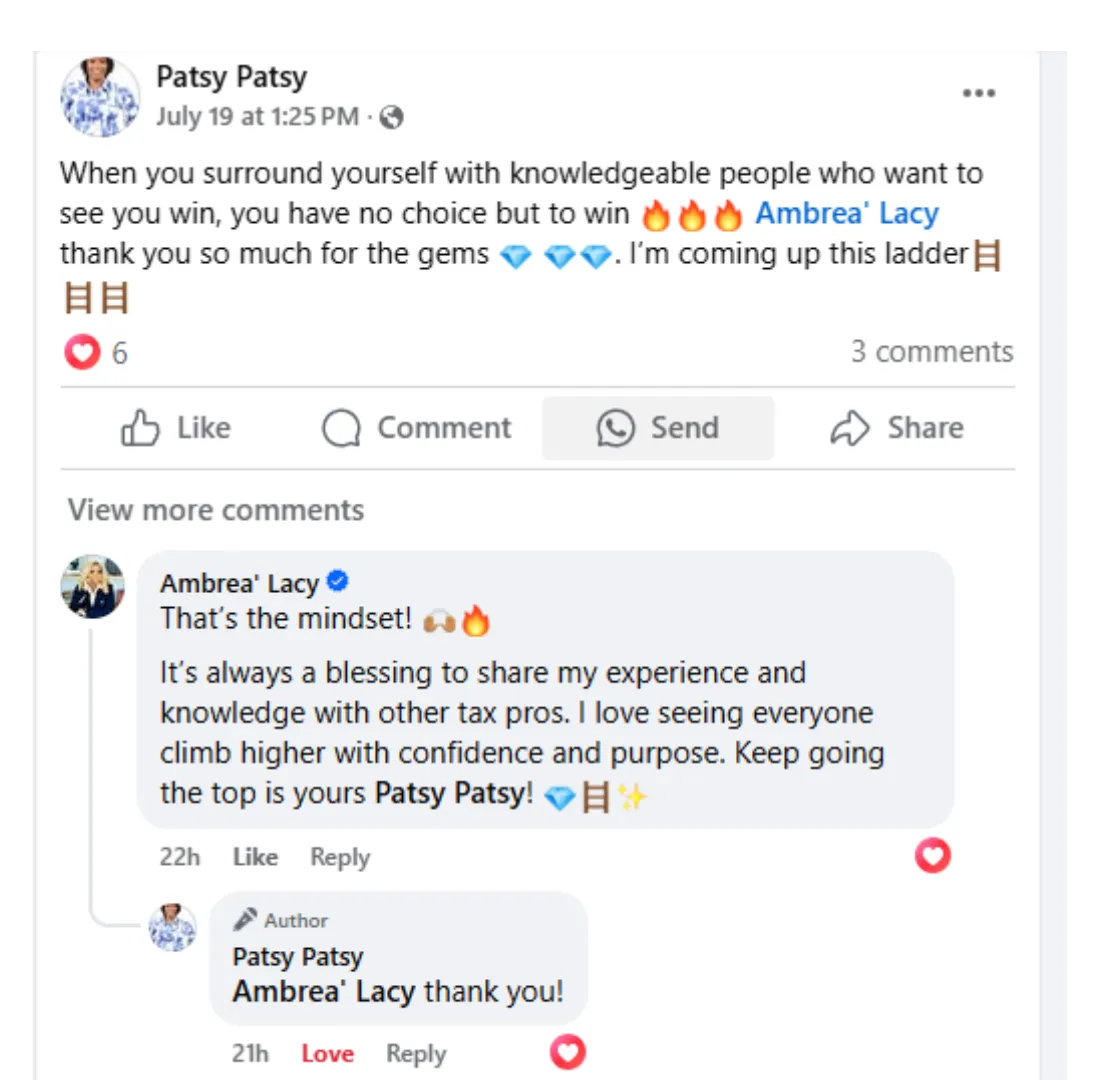

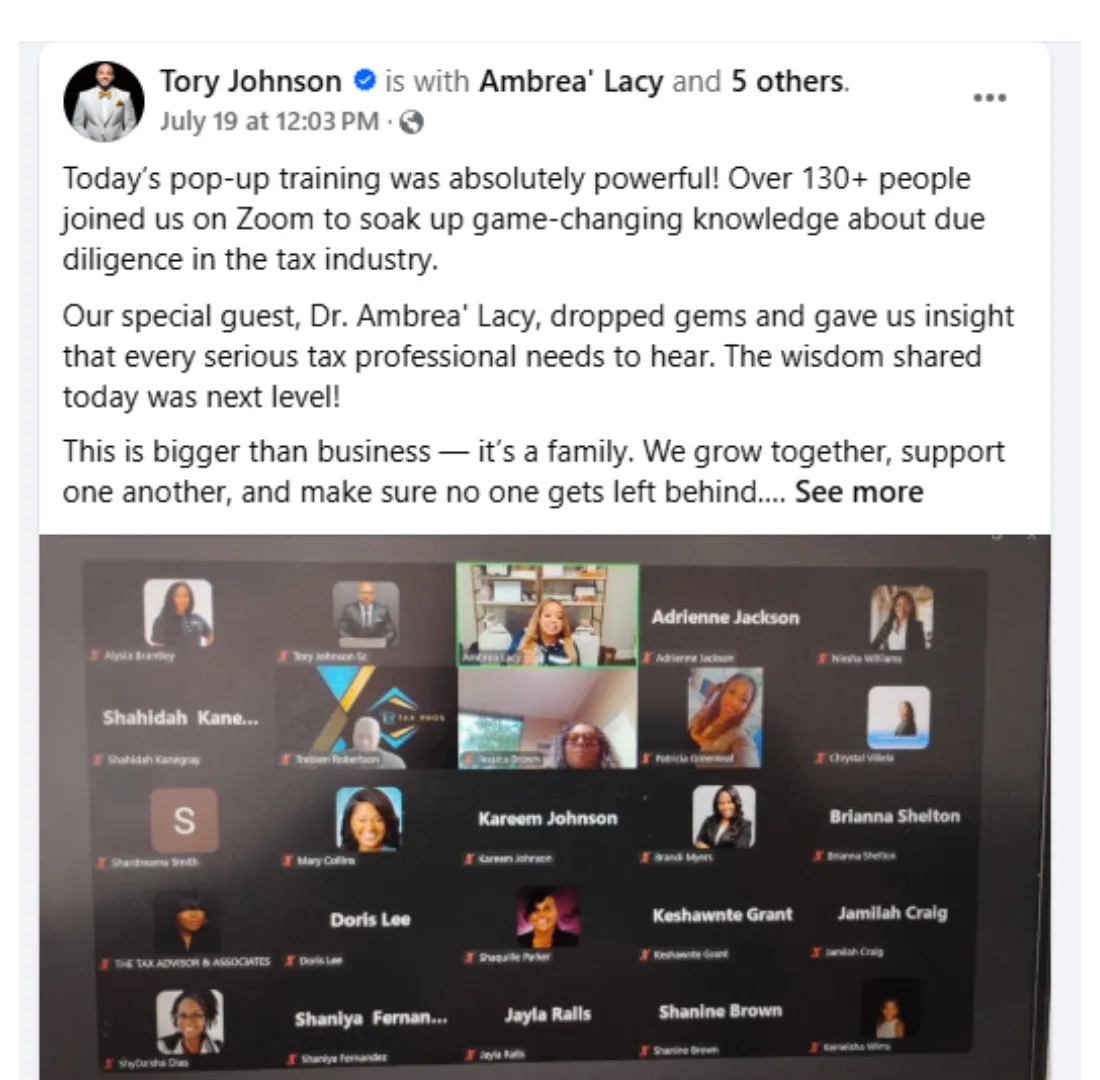

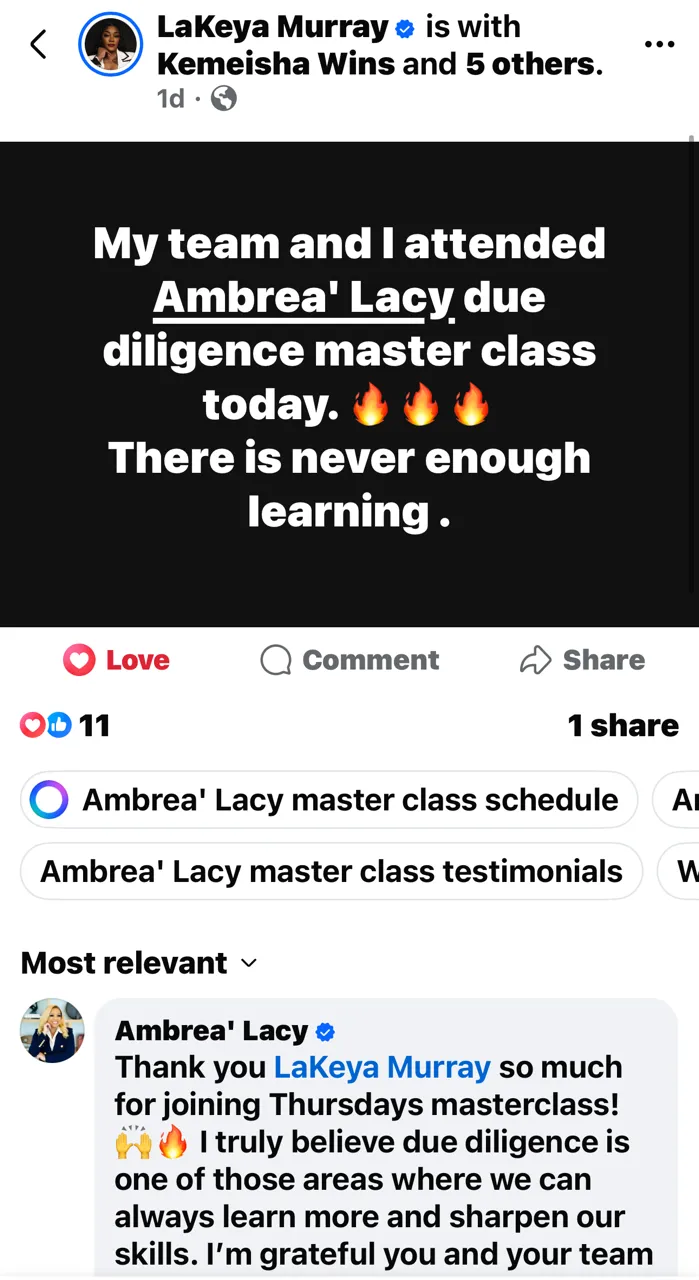

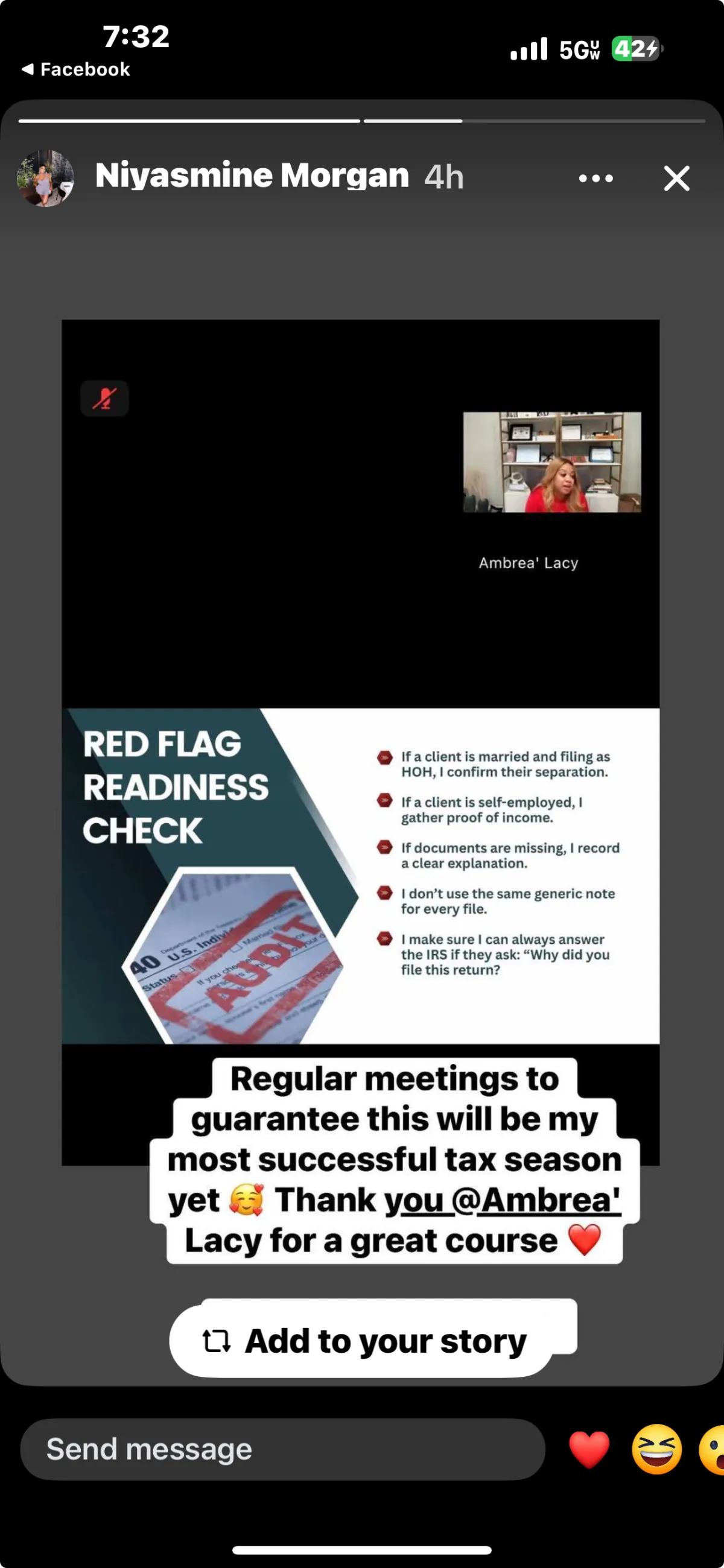

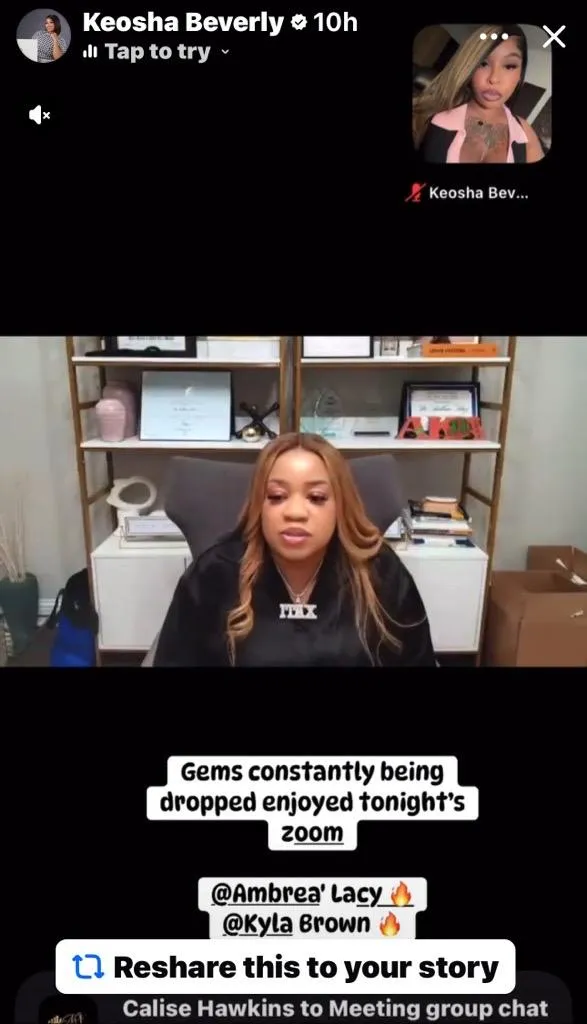

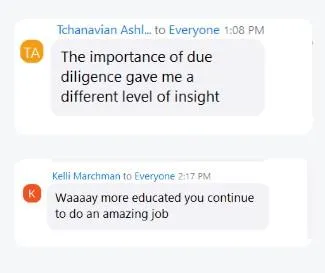

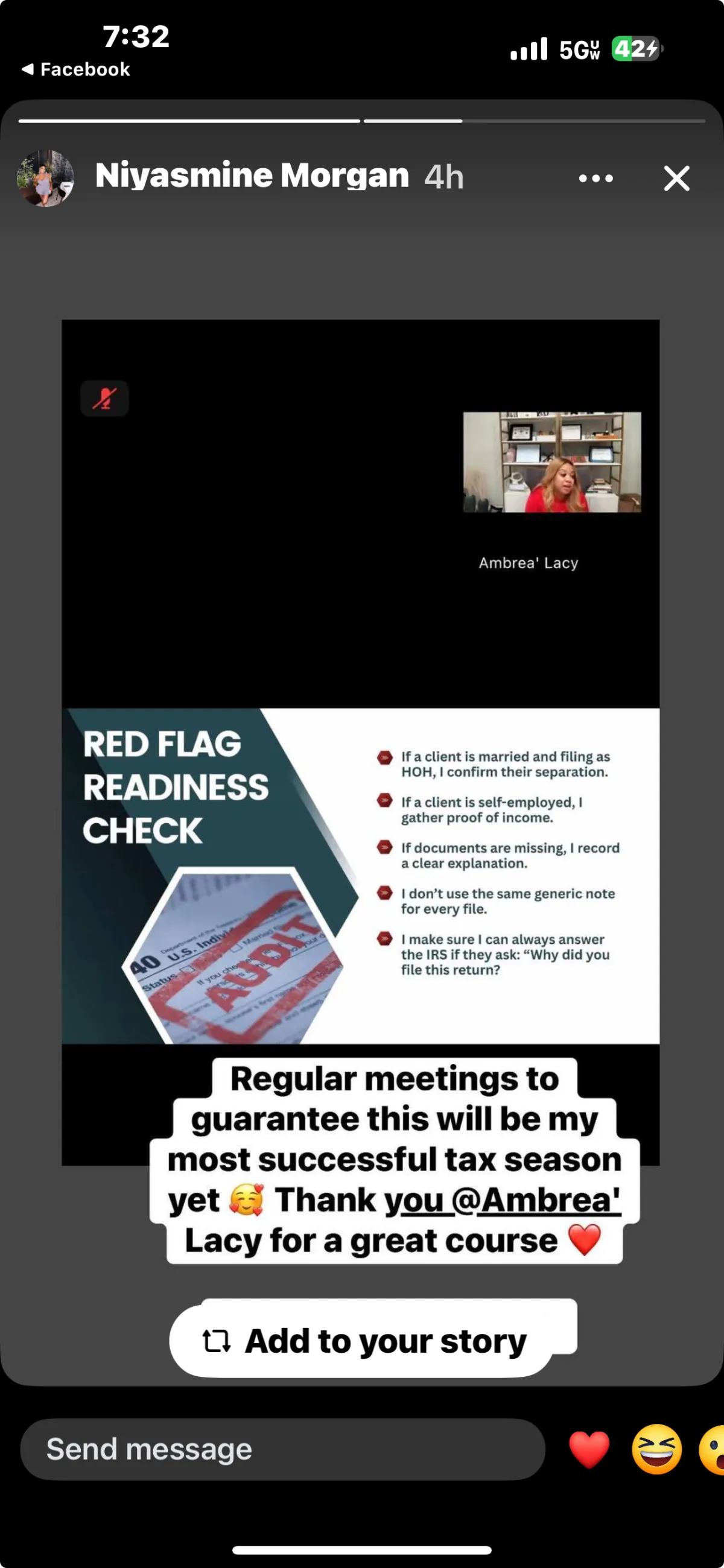

See What Real Tax Preparers Are Saying After Attending This Masterclass

Real feedback from professionals who walked in unsure — and left confident, compliant, and ready to protect their practice.

Upcoming Live Masterclass on

Currently Unavailable. We’ll Be Back Soon.

See What Real Tax Preparers Are Saying After Attending This Masterclass

Real feedback from professionals who walked in unsure — and left confident, compliant, and ready to protect their practice.

Who Must Comply with Due Diligence?

Paid tax professionals who assist clients in claiming:

Earned Income Tax Credit (EITC)

Child Tax Credit (CTC) & Additional Child Tax Credit (ACTC)

American Opportunity Tax Credit (AOTC)

Head of Houehold (HOH) Filing Status

If you prepare any of the above, this masterclass is essential for you.

Why This Masterclass Was Created

Every year, thousands of tax professionals are penalized not because they lack skill, but because the IRS increases scrutiny and compliance requirements. Many don’t even realize they’re at risk until it’s too late.

This masterclass was created to give you the tools, clarity, and confidence to navigate due diligence with ease. Our mission is simple: to protect tax preparers from devastating fines, loss of reputation, and license suspension, so you can focus on serving your clients and growing your practice.

You don’t have to figure this out alone. This session was designed with you in mind.

Here’s What You’ll Learn

The IRS due diligence requirements every paid tax preparer must know

How to avoid up to $65,000 in penalties

The exact documentation and questions you need to stay compliant

Real-world examples of what the IRS looks for during audits

Best practices to confidently prepare EITC, CTC/ACTC/ODC, AOTC, and HOH returns

Strategies to protect your PTIN and your business

Why Attend This Live Masterclass?

Here’s what you gain by showing up live.

Discover compliance shortcuts that save time and stress

Gain clarity on IRS requirements with step-by-step guidance

Avoid fines and protect your income

Position yourself as a trusted, knowledgeable preparer

Walk away with confidence for the upcoming tax season

MEET Your COMPLIANCE COACH

Dr. Ambrea' Lacy

With over a decade of experience, she’s helped hundreds of preparers grow their businesses through expert mentorship and cutting-edge software solutions.

As the founder of a top-tier tax software company, Ambrea’ blends innovation with real-world strategy, giving professionals the tools and confidence to scale with purpose. Whether you’re just starting out or ready to level up, Ambrea’ is here to help you lead, grow, and succeed.

Upcoming Live Masterclass on

Currently Unavailable. We’ll Be Back Soon.

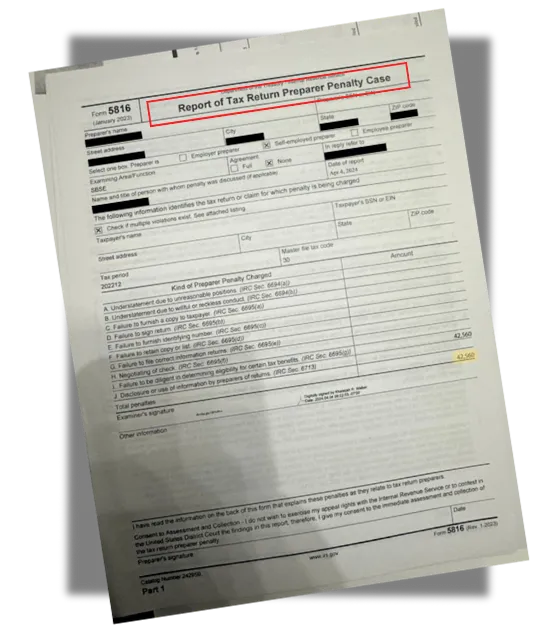

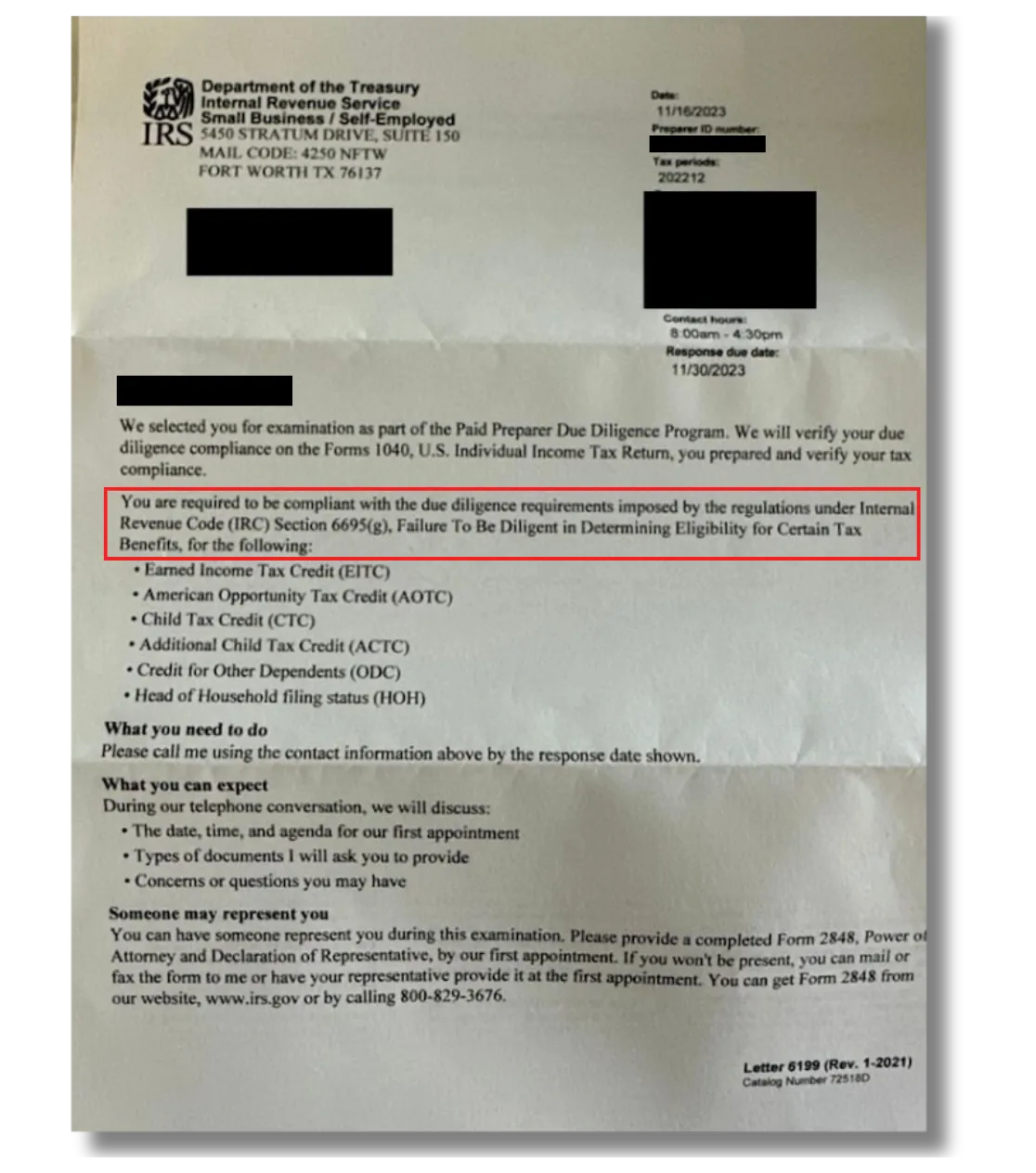

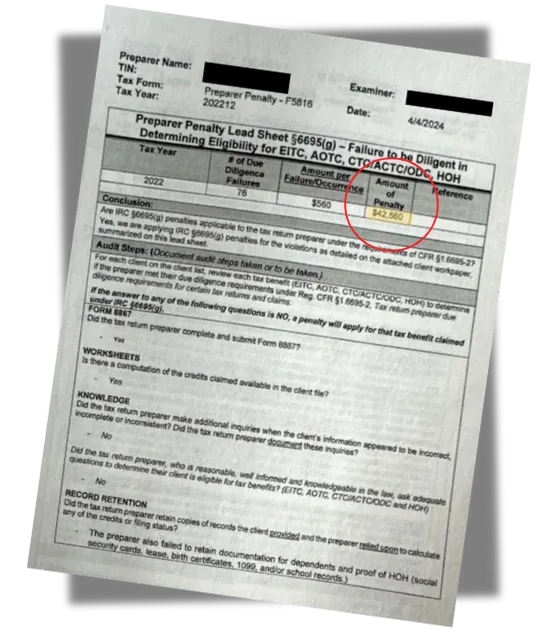

ARE YOU AT RISK?

Tax professionals face unprecedented scrutiny.

One mistake can cost your entire practice.

These are just a few of the notices that could land in your mailbox.

Do you know what to do

if you get one?

Frequently Asked Questions

Everything you need to know about the masterclass

Who is this LIVE FREE Due Diligence Masterclass for?

This training is designed for tax professionals at all levels who want to stay compliant, protect their businesses, confidently handle IRS audits, and avoid due diligence penalties of up to $63,500.

When and where is the FREE Due Diligence Masterclass?

The Masterclass is FREE and hosted LIVE every Thursday at 12:00 PM CST on Zoom. You can join from anywhere. Once you register, you’ll receive your access link.

👉Reserve your free spot now and invite another tax professional who needs this training too.

Why should I attend this FREE Due Diligence Masterclass?

Because IRS due diligence mistakes can cost you up to $63,500 in penalties. This free training will show you exactly what the IRS expects, how to protect your business, and how to document properly so you can handle audits with confidence and keep more of your hard-earned money.

How long is the Masterclass?

The session lasts about 60–90 minutes and is packed with real-world examples, step-by-step guidance, and actionable strategies you can use right away.

Can I watch the Masterclass later if I miss it?

This masterclass is live only and will not be recorded. To get all the critical information and strategies, you need to attend at the scheduled time. Don’t miss your chance to join live!

Where can I get more resources after the Masterclass?

We’ve created ebooks and guides filled with tools, templates, and strategies you can start using right away.

Can I get personalized help?

Yes! You can book a free one-on-one consultation to discuss your specific challenges and get guidance tailored to your practice. If you want a personalized and intimate due diligence coaching session for your team, or prefer learning with others, you can also inquire about our group coaching programs to apply best practices alongside other tax professionals.

👉Book your free consultation or learn more about group coaching

Have another question? We'll answer it during the live Q&A session!

Your Practice's Protection Starts Here

Don't wait for the IRS to knock on your door.

Secure your seat in this life-saving masterclass

before it's too late.

Upcoming Live Masterclass on

Currently Unavailable. We’ll Be Back Soon.

Masterclass Starts In:

Live

Every Thursday

100%

Live + Interactive

Real strategies from industry experts

⚠️ WARNING:

Limited seats available.

Don't miss your chance to protect your practice.